Portugal stands out as one of Europe’s most open and investor-friendly real estate markets. Known for its stable economy, transparent property laws, and long-term residency incentives, the country attracts individuals, companies, and DAOs looking to diversify their land holdings within a well-regulated environment.

This guide explains how land ownership works in Portugal — including foreign ownership rules, the acquisition process, taxes, risks, and how LandDAO structures its approach for compliance and transparency. It’s part of LandDAO’s broader series on country land frameworks, offering DAO members a clear understanding of land acquisition realities in each region.

Foreign Ownership Rules in Portugal

Portugal’s real estate market is notably open to foreign participation. Both individuals and entities, regardless of nationality, can freely own land and property in the country.

Key points:

- Foreigners can purchase, hold, and sell property in Portugal without residency requirements.

- Ownership rights are equivalent to those of Portuguese citizens.

- Foreign-owned entities are also eligible to own land directly.

However, certain limitations apply depending on the property type or location:

1. Restrictions on Agricultural Land

- Land within the National Agricultural Reserve (RAN) requires special authorization for purchase or development.

- Intended use must align with agricultural purposes unless reclassified by municipal authorities.

2. Restrictions in Protected Zones

- Properties located in the National Ecological Reserve (REN) or near areas of environmental or cultural heritage (e.g., coastal or forest zones) may require additional environmental approvals.

3. Requirements for Non-Residents

- Non-residents must obtain a Portuguese Tax Identification Number (Número de Contribuinte or NIF) to legally purchase and register property.

4. Tax Obligations

- All property acquisitions are subject to taxes including IMT (Property Transfer Tax), Stamp Duty, and IMI (Municipal Property Tax).

For LandDAO, these frameworks enable compliant acquisition under clear, enforceable property law — making Portugal a model for DAO-based ownership of European land.

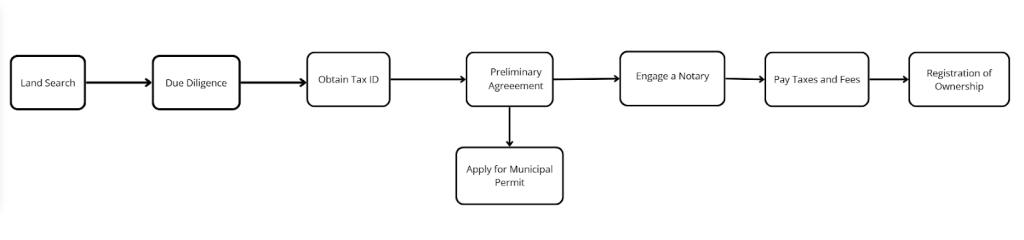

Process of Land Acquisition in Portugal

Buying land in Portugal follows a structured legal process designed to ensure transparency and protect both buyers and sellers.

Process of Land Acquisition in Portugal

1. Due Diligence

Before any purchase, legal verification is essential. Here are the required documents:

- Land Registry Extract (Certidão Permanente do Registo Predial): Confirms ownership and encumbrances.

- Cadastral Map (Planta Cadastral): Outlines property boundaries.

- Zoning Compliance Certificate (Certidão de Viabilidade Construtiva): Confirms development permissions.

2. Obtain a Tax Identification Number (NIF)

A NIF is required for all property transactions. The application process is as follows:

- Apply at a Portuguese Tax Office or through a local legal representative.

- Provide a passport and proof of residence or representative’s address.

3. Preliminary Agreement (Contrato de Promessa de Compra e Venda)

This binding pre-contract outlines sale terms. It includes:

- Purchase price and deposit (usually 10–30%).

- Timelines and conditions (e.g., zoning approval).

- Penalty clauses for breach.

4. Obtain Permits (for Development or Agricultural Land)

If construction or re-zoning is planned, approval must be sought from the local municipality. Required documents:

- Land Registry Extract.

- Development plans.

- Environmental or zoning certificates.

5. Engage a Notary (Notário)

The notary ensures legal compliance and drafts the final deed. Responsibilities:

- Verify ownership and identity.

- Ensure taxes (IMT, Stamp Duty) are paid.

- Register the deed with the Land Registry.

6. Final Deed (Escritura de Compra e Venda)

- Signed before the notary.

- Buyer pays the remaining amount.

- Transaction is officially registered.

7. Payment of Taxes and Fees

- IMT: 2–8% (based on property value).

- Stamp Duty (IS): 0.8%.

- Notary & Legal Fees: 1–2%.

8. Registration of Ownership

Ownership is finalized at the Conservatória do Registo Predial, and the new Title Deed (Certidão de Propriedade) is issued.

Natural Disaster and Environmental Risks

Portugal’s geographic diversity brings both advantages and environmental challenges.

Flooding

- High-risk areas include Lisbon, Algarve, and Tagus River valleys.

- Increasing sea levels heighten risks in coastal zones.

Earthquakes

- Moderate seismic risk, especially in Lisbon, Algarve, and Madeira.

- Estimated 10% probability of a damaging quake in 50 years.

Climate Change Impacts

- Sea-Level Rise: Threatens coastal infrastructure.

- Extreme Weather: Northern Portugal faces intense rainfall; Alentejo prone to droughts.

LandDAO incorporates these risk factors into its acquisition model, prioritizing resilient regions with sustainable development potential.

LandDAO’s Strategy in Portugal

To ensure transparency, security, and DAO-compliant ownership, LandDAO operates on five guiding principles:

- Full Legal Compliance — Acquire only through verified notaries and within RAN/REN regulations.

- Independent Legal Review — All acquisitions are vetted by Portuguese legal experts.

- DAO Transparency — Due diligence data and valuations are shared with members pre-acquisition.

- Local Partnerships — Collaborate with reputable agencies and notaries.

- Sustainable Value Creation — Prioritize lands suited for agriculture, eco-development, or conservation.

This model ensures members participate in the Portuguese land market through a secure, transparent, and legally sound framework.

Join the Movement — Become a DAO Member

Portugal’s property framework combines investor openness with strong legal safeguards making it a strategic target for LandDAO’s European expansion. By joining LandDAO, members gain early access to tokenized land opportunities in Portugal and other regulated markets worldwide.

Join the LandDAO Token Sale Waitlist now to get access to the token sale and become a LandDAO member.