At LandDAO, we are committed to making land transactions easy and transparent. We only work directly with landowners; no intermediaries, no agents. If you own land and wish to sell it to LandDAO, this guide explains the process, key requirements, and important details to include in your submission. Who Can Sell Land to LandDAO? To ensure a smooth transaction, below are the conditions that must be met: Submit Your Land Information To initiate the selling process, landowners must complete our Land Submission Form with the following key details: 1. Exact Location & GPS Coordinates: 2. Land Ownership Proof: 3. Land Size: 4. Land Use & Current Condition: Why Sell to LandDAO? Selling your land to LandDAO comes with several practical benefits. The following points outline what you can expect from the process: If you are interested in selling your land to LandDAO, please complete the Land Submission Form to begin the process.

How LandDAO Generates Revenue from Tokenized Land

Land ownership has long been considered one of the most valuable assets, but traditional real estate markets often come with high barriers to entry, slow transactions, and legal complexities. LandDAO ($LNDAO) is changing that by tokenizing real-world land assets (RWA) and making them accessible on the blockchain. For investors interested in LandDAO, understanding how the platform generates revenue is key. A sustainable revenue model ensures growth, reinvestment, and long-term success. LandDAO operates with five primary revenue streams, allowing the DAO to remain financially strong while offering profitable opportunities to token holders. 1. Primary Sales: Profiting from Tokenized Land Sales At the heart of LandDAO’s revenue model is the sale of tokenized land assets. The process starts with acquisition, where LandDAO buys large parcels of real land in strategic locations. The land is then improved, adding infrastructure such as roads, electricity access, and land demarcation, to increase its value. When investors purchase these tokenized parcels on the LandDAO marketplace, the DAO earns revenue from the primary sale. This process benefits both the DAO and investors, as it allows for easy land ownership without the complexities of traditional real estate. Example: LandDAO acquires 500 acres of land, improves the property, and tokenizes it into 1,000 land parcels. Investors can buy and trade these tokens, and the DAO generates profit from the initial sale. 2. Recurring Leasing Fees: Turning Land into a Passive Income Source Not all lands in LandDAO’s portfolio are sold immediately. Some parcels, especially agricultural lands, are leased to farmers and agribusinesses. This ensures steady revenue flow while allowing businesses to use the land productively. Leasing fees are collected periodically, providing passive income to the DAO while creating real-world economic value. By leasing land rather than outright selling it, LandDAO secures long-term revenue and maintains ownership over valuable assets. Example: A commercial farm leases 100 acres from LandDAO for 10 years, paying annual lease fees. These recurring payments generate stable income for the DAO and its token holders. 3. Marketplace Fees: Earning from Every Land Trade LandDAO operates a decentralized marketplace where investors can buy and sell tokenized land. Every time a transaction occurs on this platform, LandDAO collects a 3.5% marketplace fee. This fee structure incentivizes trading activity while ensuring a continuous revenue stream for the DAO. Since tokenized land can be bought and sold without the delays of traditional real estate transactions, the marketplace fosters liquidity and frequent trading. Example: An investor sells their land token for $10,000 on the LandDAO marketplace. A 3.5% fee ($350) is collected by LandDAO, adding to its revenue. 4. Secondary Transaction Royalties: Benefiting from Resales Even after the initial sale, LandDAO continues to earn from land trades through secondary transaction royalties. A 2% royalty fee is applied whenever a land token is resold, ensuring the DAO benefits from continued market activity. This model is inspired by NFT royalties, where creators earn from resales of digital assets. In LandDAO’s case, royalties ensure ongoing revenue generation beyond primary sales, strengthening the DAO’s financial position over time. Example: A tokenized land parcel initially sold for $5,000 is later resold for $7,000. LandDAO earns a 2% ($140) royalty fee from this secondary transaction. 5. Annual Land Management Fees: Covering Operational Costs Managing a large land portfolio requires maintenance, legal oversight, and security measures. To cover these ongoing operational costs, LandDAO charges a 0.25% annual land management fee. This fee helps fund land upkeep, property security, governance operations, and compliance processes, ensuring all land assets remain valuable and tradeable. Without this fee, land investments could depreciate due to mismanagement, but LandDAO ensures each parcel is properly maintained and legally protected. Example: A large-scale farm leased from LandDAO requires periodic inspections, security, and infrastructure maintenance. The 0.25% annual fee helps cover these costs, ensuring long-term sustainability. The Future of Land Ownership Starts Here Want to be part of the future of tokenized land? Subscribe now to receive exclusive updates and early investment opportunities with LandDAO. Join the LandDAO Token Sale Waitlist for First Access to the $LNDAO Token Sale.

Land Tokenization and Why it Matters

The concept of land ownership has remained largely unchanged for centuries, relying on physical deeds, complex paperwork, and often with high barriers to entry. However, with the advent of blockchain, this traditional model is beginning to shift. Land tokenization, as implemented by LandDAO, involves converting land rights into digital assets on a blockchain — potentially transforming how land is bought, sold, and managed. By enabling more accessible, transparent, and secure land transactions, LandDAO is helping to redefine real estate ownership in the digital age. This article explores the mechanics of land tokenization, its potential benefits, and the challenges it faces in reshaping the future of land ownership What is Land Tokenization? Land tokenization is the process of converting ownership rights of physical land into digital assets represented and managed on a blockchain. These digitized assets, or real-world assets represent the ownership of the land, either in whole or in part. This allows for various ownership models, including full ownership of a land, or fractional ownership where multiple buyers can each own a portion of the property. By tokenizing land, the process creates a digital representation of ownership that can be more easily transferred, divided, or traded on blockchain-based platforms. How does Land Tokenization Work? The process of tokenizing land involves several key steps, as illustrated in the following chart: Benefits of Land Tokenization Land tokenization offers several compelling advantages: Challenges and Risks of Land Tokenization Despite its potential benefits, land tokenization is not without challenges: Conclusion Land tokenization represents a significant leap in the real-world asset sector, leveraging blockchain to streamline and democratize property transactions. By converting land into digital assets, this approach enhances accessibility, liquidity, and allows for fractional ownership, making land investments more attainable for a broader audience. As this innovative concept continues to evolve, it has the potential to reshape the landscape of property ownership, making it a crucial development. Join the LandDAO Token Sale Waitlist for First Access to the $LNDAO Token Sale.

Addressing the Challenges in Land Ownership: LandDAO’s Solution

Land ownership is a foundation of wealth and security, yet the process of acquiring, managing, and transferring land remains plagued with inefficiencies and a lack of transparency. Whether it’s residential properties or agricultural land, the challenges are consistent across different types of assets. LandDAO (LNDAO) offers a solution through land tokenization, transforming how both residential and agricultural land assets are acquired, traded, and managed. This article explores the issues with traditional land ownership models and how LandDAO’s approach provides a more accessible and equitable pathway to land ownership. Current Challenges in Land Ownership Models LandDAO: A Solution to Land Ownership Challenges LandDAO converts land assets into digital tokens that can be easily traded, making land ownership more liquid and accessible. LandDAO’s portfolio includes land assets across various regions, such as Africa, South America, Southeast Asia, and Eastern Europe. The portfolio includes both residential and agricultural land, providing diverse investment opportunities. LandDAO utilizes smart contracts to manage the ownership, transfer, and trading of land tokens, ensuring transparency and security in all transactions.This approach offers a high degree of transparency, providing a tamper-proof and secure system. LandDAO’s approach includes initiatives to invest in and support the local communities where its land assets are located, fostering economic development and social well-being. Potential Impact of LandDAO’s Approach Conclusion In summary, traditional land ownership faces issues of inefficiency, inaccessibility, and poor transparency. LandDAO addresses these challenges by tokenizing land assets, making real estate more liquid, accessible, and globally tradable. Through blockchain-based ownership and a diverse portfolio, LandDAO is set to reshape land ownership, offering a more inclusive and efficient model for the future. Join the LandDAO Token Sale Waitlist for First Access to the $LNDAO Token Sale.

How LandDAO is Changing Lives

At LandDAO, we believe in creating lasting, positive change for the communities where we invest. Our commitment goes beyond mere land transactions; it encompasses an approach to community development and empowerment. Here’s how our land purchases directly benefit indigenous populations: One of the primary benefits of our land purchases is the immediate influx of capital into local communities. The funds from these transactions are often directed towards building essential infrastructure such as roads, schools, and utilities. These developments not only improve the quality of life but also lay the groundwork for future economic growth. 2. Job Creation We prioritize hiring locals for our projects, which helps to create employment opportunities and foster economic stability. By ensuring that job opportunities are accessible to the community, we help to reduce unemployment rates and stimulate local economies. 3. Skills and Knowledge Transfer Our projects are designed to include skill acquisition opportunities. By empowering locals with new skills and expertise, we ensure that the benefits of our investments are long-lasting. This skills transfer is crucial for the continued growth of the communities we work with. 4. Economic Boost from New Residents The influx of new residents to our developed lands creates increased demand for local goods and services. This boost in demand generates more revenue for local businesses, contributing to a thriving local economy and encouraging further entrepreneurial ventures. 5. Joint Ventures and New Businesses Collaboration between local communities and foreign investors often leads to the creation of new business ventures. These joint ventures can span various industries, including farming, food processing, and more, providing diverse opportunities for economic growth. 6. Foreign Direct Investment (FDI) Our projects attract foreign investors who might not have considered these communities otherwise. This influx of foreign direct investment drives further economic growth and helps to integrate local economies into the global market. 7. Tax Revenue Generation Enhanced economic activities resulting from our projects contribute to tax revenue for both local and national governments. This additional revenue can be reinvested into public services and infrastructure, creating a virtuous cycle of development. Conclusion Through our comprehensive approach to development, we ensure that our land purchases have far-reaching benefits, fostering economic growth, enhancing quality of life, and empowering local populations. By joining LandDAO, you not only gain valuable assets but also contribute to the betterment of communities around the world. Join the LandDAO Token Sale Waitlist for First Access to the $LNDAO Token Sale.

How LandDAO Works: A Video Explainer

LandDAO has just released an animated explainer video showcasing our innovative approach to Real World Asset (RWA) tokenization in real estate. In just three minutes, the video covers our strategy for acquiring and tokenizing land in emerging markets, and explains how smart contracts ensure secure property transactions. It also features our first tokenized land project in Ghana’s Kwahu Mountains. Watch now on our YouTube channel: Join the LandDAO Token Sale Waitlist for First Access to the $LNDAO Token Sale.

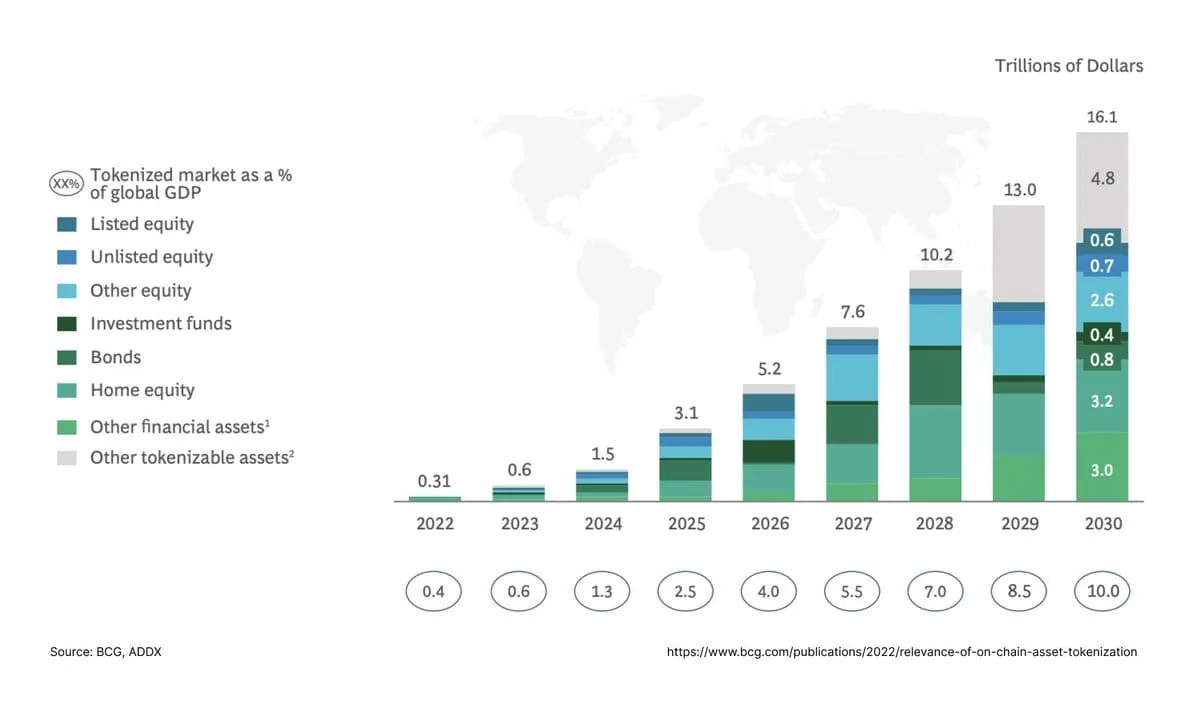

The $16 Trillion Market: Inside the Explosive Growth of Real-World Asset Tokenization

Real-World Asset (RWA) tokenization is changing the way traditional assets are handled. It is revolutionizing how people buy, sell, and invest in physical assets by creating digital representations of them. This process is breaking down long-standing barriers in traditional finance and opening up new possibilities for blockchain investors worldwide. According to a research by Boston Consulting Group, the RWA tokenization market is set to reach a staggering $16 trillion by 2030. This astronomical figure underscores the transformative potential of this technology and sets the stage for an exploration of this rapidly evolving landscape. The Rise of RWA Tokenization The growth of the RWA market in the blockchain space has been nothing short of explosive. As of December 2023, the total value locked (TVL) in RWA decentralized finance projects reached $5.472 billion, representing a remarkable 730% increase from just six months prior. This growth rate positions RWA tokenization as one of the fastest-growing sectors in the blockchain space. Several factors are driving this unprecedented growth: The breadth of assets being tokenized is vast, encompassing real estate, bonds, stocks, precious stones, and even fine art. This diversity shows that tokenization can be applied in various different industries. General RWA Market Leaders At the forefront of the RWA revolution is ONDO Finance, boasting a market cap of $1.6 billion. ONDO’s unique selling point is its ability to provide on-chain access to traditional financial products, such as exchange-traded funds from industry giants BlackRock and Vanguard. This bridge between traditional finance (TradFi) and decentralized finance (DeFi) has positioned ONDO as a market leader. Other key players in the space include: The entry of traditional finance behemoths like BlackRock into the RWA space signifies growing mainstream acceptance. BlackRock’s BUIDL fund, which attracted $240 million in its first week, demonstrates the appetite for RWA products among institutional investors. Real Estate: A Prime RWA Use Case The global real estate market, valued at an estimated $637.80 trillion in 2024, presents a prime opportunity for tokenization. Traditionally, real estate investing has been plagued by challenges such as: Blockchain and tokenization address these issues by enabling fractional ownership, creating a global, 24/7 marketplace for real estate tokens, and increasing liquidity through easier trading of ownership stakes. According to a recent study by Texture Research, real estate is the most preferred asset class for tokenization, with 58% of respondents favoring it. The chart below illustrates the preferences for various real-world assets (RWA): Leading Real Estate RWA Projects Several innovative platforms are leading the charge in real estate tokenization: These platforms are gaining traction, with increasing numbers of properties being tokenized and traded on their respective marketplaces. Land Tokenization: The Next Frontier While property tokenization has gained significant traction, an emerging concept within the RWA space is land tokenization. This innovative approach focuses on tokenizing land itself. LandDAO is at the forefront of this movement. As a decentralized autonomous organization, LandDAO aims to leverage blockchain technology to tokenize physical land into fungible tokens. This approach could revolutionize land ownership and trading by: The potential impact of land tokenization extends beyond investment. It could reshape how people approach land use, urban planning, and even environmental conservation. The Future of RWA Tokenization As the RWA tokenization market continues to evolve, several trends and growth areas are emerging: However, challenges remain. Regulatory hurdles, particularly around securities laws and cross-border transactions, need to be addressed. Additionally, market education and adoption among retail investors remain ongoing challenges. The long-term implications of RWA tokenization for traditional finance are profound. It has the potential to: Conclusion The tokenization of real-world assets is reshaping the financial landscape. From ONDO Finance to innovative real estate platforms like Propy and Blocksquare, RWA tokenization is breaking down barriers to investment and liquidity. Emerging concepts like LandDAO’s land tokenization further expand the possibilities. As this market grows, it promises to democratize access to traditional assets and revolutionize traditional finance. While challenges remain, the potential for investors, and the broader financial ecosystem is immense. RWA tokenization isn’t just a trend — it’s a force bridging blockchain technology with mainstream asset investments, paving the way for a more accessible and liquid financial future. Join the LandDAO Token Sale Waitlist for First Access to the $LNDAO Token Sale.

LandDAO: Unlocking Global Land Ownership Through Tokenization

The concept of tokenization has emerged as a revolutionary force, disrupting traditional asset ownership models. By leveraging blockchain technology, tokenization converts real-world assets into digital tokens that represent ownership. One market that has long faced challenges is the real estate market. Factors such as geographical constraints, complex legal frameworks, and high capital requirements have made it difficult for crypto investors and traders to buy and trade land. However, a new real-world asset project, LandDAO, has emerged. This innovative decentralized platform harnesses the power of tokenization to unlock land ownership with a click of a button from your smartphone or computer. What is LandDAO? LandDAO is a decentralized autonomous organization focused on using blockchain smart contracts to tokenize physical (real) land into a fungible token and making it tradeable for land buyers and sellers. Lands traded on LandDAO are real lands and NOT virtual lands. At its core, LandDAO operates on a model where members collectively pool resources to acquire large acreages of land in countries around the world. These land parcels are improved and tokenized on the blockchain, allowing participants to own, trade, and even develop their lands if they wish. We make land tradeable as a tokenized RWA (Real World Asset) using smart contracts. Unlike other projects that tokenize residential or commercial properties, LandDAO is focused on only land tokenization, tokenizing both residential and agricultural lands. By concentrating solely on land, LandDAO offers crypto traders targeted exposure to land investments. This approach ensures that participants have tangible ownership of real-world assets, providing a unique investment opportunity with potential for long-term value appreciation and economic development of communities where the lands are located. LandDAO’s Key Features and Advantages LandDAO’s Tokenization Process Tokenization is the process of using smart contracts to convert real-world assets into tradeable digital tokens on a blockchain network. In the context of LandDAO, the tokenization process follows a structured approach: Land Acquisition: LandDAO pools funds from its members to purchase large acreages of land in targeted regions. Land Development: LandDAO undertakes infrastructure improvements on the lands to increase the land’s value and to make it attractive for future residential buyers and commercial farming activities. Tokenization: LandDAO tokenizes the land parcel by creating digital tokens on a blockchain network, where each token (NFT) represents ownership of the underlying land. These tokens can then be traded, transferred, or held by investors, providing liquidity and accessibility to an asset class that traditionally lacks such characteristics. Tokenization of land makes it easily transferable from one land holder to another just like any NFT. Market Trends and Opportunities The demand for alternative investment opportunities and the rise of real-world asset tokenization have been gaining significant momentum in recent months. A Binance study in July 2023 estimated the tokenized asset market to reach a staggering $16 trillion by 2030, up from $310 billion in 2022, driven by tokenization of traditional finance assets such as real estate, bonds, gold, equities, and ETFs. The RWA market’s growth is further evidenced by the total value locked (TVL) on DeFiLama, which surged from $770 million in July 2023 to $5.472 billion in December 2023 — a remarkable 730% increase, positioning it as one of the fastest-growing blockchain categories. This rapid expansion positions the RWA market as one of the fastest-growing categories in the blockchain space, highlighting its immense potential. Why Join LandDAO Social Impact LandDAO’s Vision and Roadmap LandDAO is currently in the pre-launch phase. You can read more about LandDAO by visiting our landing page and reading the Executive Summary. To get updates on the launch of LandDAO, leave your email behind on the landing page and also invite your friends. LandDAO envisions a future where tokenized land assets traded on LandDAO not only generate returns for DAO members but also catalyzes economic development for the local population in communities where it operates. Join the LandDAO Token Sale Waitlist for First Access to the $LNDAO Token Sale.